You may owe tax for just holding a spot ETH or spot BTC exchange traded fund (ETF) in 2024

Published: February 6, 2025

Overview

US taxpayers could be at risk of under-reporting gains and/or losses on their tax return if they bought a spot BTC or spot ETH exchange traded fund (ETF) in 2024, even if they simply held the ETF (did not sell/exchange their interest in the ETF). This is because US taxpayers don’t always get their full tax reports from their Broker when they buy investment interests like these. Taxpayers that rely on their Broker to communicate every taxable transaction to them will need to take action to self-locate and self-calculate their allocable share of taxable activities inside of the ETFs they owned during 2024 in preparing their taxes this Q1 2025.

TLDR: jump to the end of this blog for direct links to the reports you will need for your taxes.

What was the catalyst for the launch of these ETFs?

We are now 1 year since the fervor surrounding bitcoin ETF launches in the US which was followed by ethereum ETFs later in 2024. These ETFs launched with much fanfare as they gave an indirect way to invest in BTC and ETH without having to hold the crypto assets directly. Retail investors that were interested in the asset class could finally enter the arena without learning blockchain tools and jargon, like “wallets” and “private keys”. Many investors also postulated that owning a crypto ETF rather than holding crypto directly would make tax time much easier. This is because ETFs are securities and the brokers offering them on their platforms are required to issue familiar Forms 1099 when you sell your ETF holdings. This is in contrast to most sales/exchanges of crypto held directly which currently have no Form 1099 reporting (until next year when that changes).

TLDR: owning these ETFs does not make tax time much easier.

Comparing Form 1099 reporting of direct and indirect investing in crypto

Bitcoin self-custody: you self-track and self-calculate your taxes. Crypto tax software or self-built spreadsheets are a necessity.

Bitcoin on-exchange (at a centralized exchange): you self-track and self-calculate your taxes for now, with some help (that changes in 2026 for tax year 2025). Some exchanges may give you helpful reports or abbreviated Forms 1099. Some exchanges are issuing Forms 1099-MISC when you earn staking reward income on their platform. Starting in 2026 for the 2025 tax year, exchanges will give you a Form 1099-DA to report gross proceeds on sales/exchanges of digital assets (e.g. crypto), making tax time easier for you. That Form 1099 will come with an IRS instruction manual. It will not report to you acquisition or cost basis information, that only applies starting in 2027 over 2026 sales/exchanges where the assets sold/disposed were acquired after January 1, 2026.

Spot BTC or ETH ETF: I reviewed the tax sections of 19 ETF prospectuses (listed later in this blog post). All but 1 of them will be “grantor trusts” for tax purposes. Grantor trusts are treated as a pass-through type of entity so that the taxpayer (investor) is treated as owning the underlying assets directly (but only their allocable portion). While Brokers offering these ETFs on their platform will issue Forms 1099-B for 2024 sales/exchanges of the ETF itself, these same Brokers will not issue Forms 1099 to ETF holders for their allocable share of underlying fund activity. Instead, the Issuers/Trustees of the ETFs may provide a “tax information report” that contains free-form information the investor will need in order to prepare their taxes. These Tax Information Reports are not taxpayer specific (e.g. do not relate to the individual taxpayer’s allocable portion) which means investors will need to seek professional advice in order to interpret them and incorporate their allocable portion of fund-level sales/exchanges into their tax calculations.

Grantor Trust Tax Reporting in general

This grantor trust situation is not unique to spot crypto ETFs. A grantor trust is the typical tax structure of commodities ETFs (like a gold or silver ETF) though it is a less common tax structure for other types of ETFs. Most well known ETFs that track equity indexes (like the S&P 500 Index) are Regulated Investment Companies (RICs) that issue Forms 1099-DIV for taxpayer’s allocable share of underlying fund activity.

Grantor trusts are pass-through entities and do not pay tax on the gains/losses inside of the trust. Instead, the trust needs to pass the gain/loss activity on to the end taxpayer who must calculate their allocable share of the trust's gains/losses and report/pay tax where applicable. Why would a spot crypto fund have gains/losses transactions during the year? The fund needs to sell its crypto holdings in order to pay expenses, like paying the fund manager, paying the accountants, paying the auditors, and so on.

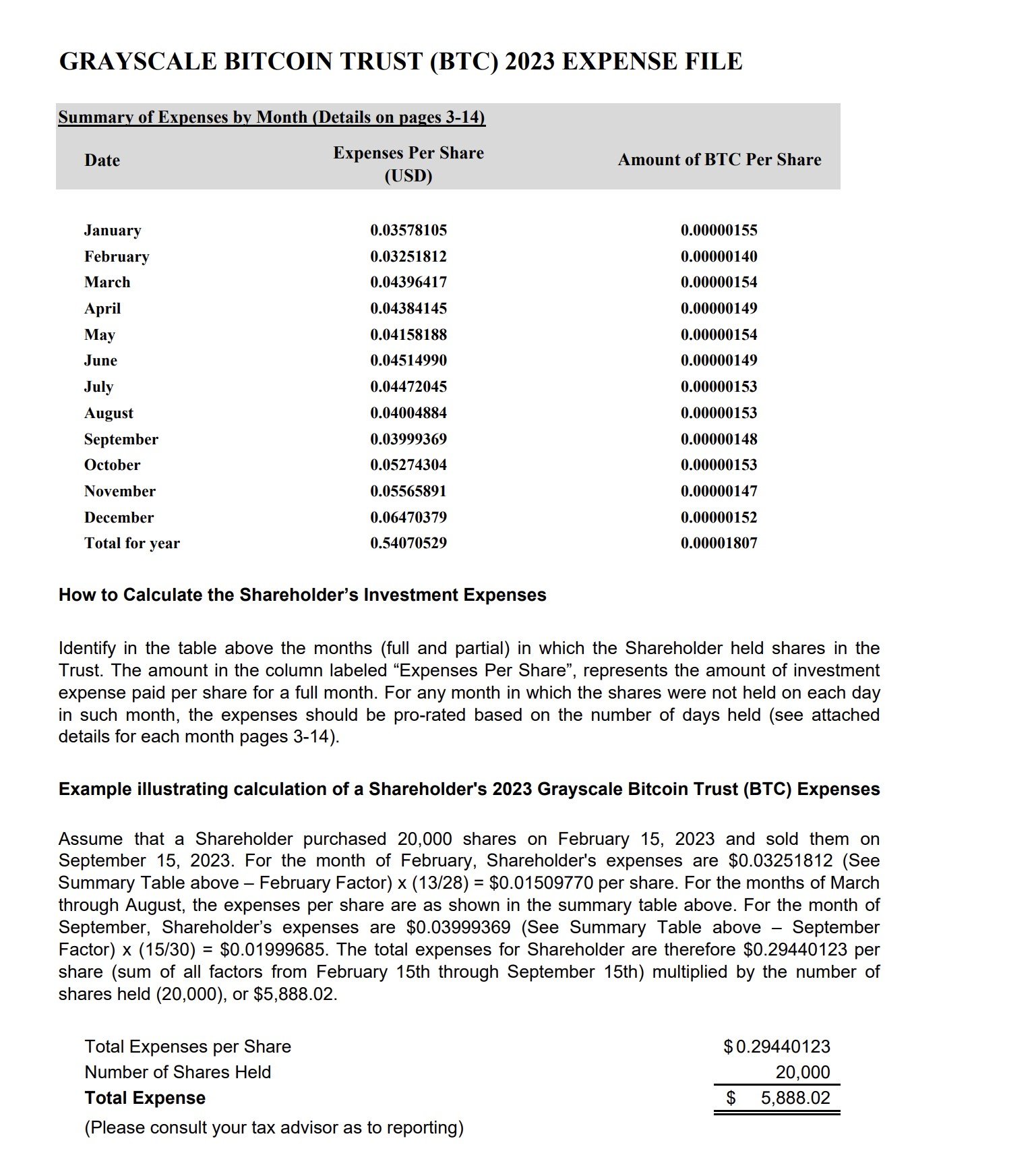

Sample Tax Information Report from Grayscale Bitcoin Trust for tax year 2023 (pages 1 and 2 of 17)

Page 1 of 17

Page 2 of 17

Broker vs Issuer/Trustee

The Issuer or Trustee of an ETF can be thought of as the fund manager that advertises the availability of the fund and decides its investment strategy (e.g. Bitwise, BlackRock, or Grayscale). Typically, retail investors are not buying interest/shares in ETFs directly from the Issuer/Trustee.

Instead, retail investors can purchase ETFs through Brokers, who are independent of the Issuer/Trustee but may earn commissions or other fees for allowing you to buy the ETF. Brokers that may make crypto ETFs available for purchase on their platform include Schwab, Fidelity, Interactive Brokers, eToro, Robinhood, and more.

Important to note that sometimes Issuers/Trustees are also Brokers but they are different arms/branches of the same business name. For example, Fidelity’s Broker services are completely different from Fidelity’s Issuer/Trustee services and therefore you must think of them independently of eachother.

What kind of transactions can generate Forms 1099? And examples of under-reporting risks

Most taxpayers rely on their Broker (e.g. Robinhood or Schwab) to provide them with their complete tax reports each year. But when grantor trusts are involved, taxpayers may only receive from their Broker a portion of the tax information necessary in order to be tax compliant. Let’s look at a “simple” example:

Year 1: Taxpayer buys/holds 100 shares of spot bitcoin ETF through their Broker

Year 2: Taxpayer holds 100 shares of ETF

Year 3: Taxpayer sells 100 shares of ETF through their Broker

In Year 3, the Taxpayer will likely receive a single Form 1099-B from their Broker reporting the sale of 100 shares of the ETF. For Years 1, 2, and 3 the Taxpayer also needs to pick up and report the gains/losses passed through to them from inside of the trust. With grantor trusts, unless the Broker has included it on a Form 1099 somewhere (hint: most do not) then it is up to the Taxpayer to go download the additional tax report from the Issuer/Trustee’s website (e.g. Grayscale for GBTC and VanEck for HODL). If the Taxpayer isn’t aware of this extra tax reporting then they may have under-reported their allocable share of fund-level gains/losses on their taxes for all 3 years.

In summary, we have two events that are occurring:

Taxpayer’s direct sale of their interest/shares in the ETF itself.

Gross Proceeds reported on Form 1099-B by the Broker.

There may not be cost basis information reported on the Form 1099-B as units in a trust are not a Covered Security required to report cost basis information. Taxpayers must self-track and self-calculate their cost basis information.

Taxpayer’s indirect and allocable share of fund-level sales/exchanges of crypto (in order to pay fund expenses in fiat currency).

Typically these gain/loss activities (gross proceeds and basis) are not reported on a Form 1099-B by either the Broker (e.g. Robinhood) or the Issuer/Trustee (e.g. Grayscale).

Instead, Taxpayers must download the Tax Information Report directly from the Issuer/Trustee’s website. Sometimes, Broker’s may include notifications about these reports or links to them but rarely will they host them directly on their (Broker) website/Tax Center.

Occasionally, these fund-level sales are reported to the Taxpayer on a Form 1099. However, this usually only happens when the sales/exchanges exceed 5% of fund assets which shouldn’t happen in a crypto ETF. As such, we can make a baseline expectation that no Form 1099 will be issued for these activities.

Starting in 2026 over the 2025 tax year, the above outcomes may have variances due to the Form 1099-DA reporting coming online. These future outcomes are not in-scope of this blog post.

Conclusion, Call to Action

Zooming out, the allocable portion of fund-level gains/losses may be very small for investors with relatively small positions in the ETF. Taxpayer’s in these small positions are typically not looking at a huge tax bill from these fund-level sales/exchange activities. Due to the complexity of the calculations, many spot crypto ETF investors will require the assistance of a tax advisor to navigate calculating and reporting tax on these activities.

Takeaway for US taxpayers:

First, you can try to proactively ask your Broker for these “extra” annual Tax Information Reports. The reality is that most Broker customer support agents will likely give a generic response about where to download your Forms 1099 in your online account.

If your Broker isn’t any help, then you need to go to the Issuer/Trustee’s website and download the report on your own. At the bottom of this blog you will find a comprehensive list of links to 2024 reports as they become available/published.

Hire a tax advisor to help you with the calculation.

Takeaway for CPAs and other tax advisors:

You should ask all of your clients if they bought these spot BTC or spot ETF funds during 2024 (even if they did not dispose of anything) so you can ensure that you pickup these transactions in their tax returns.

Links to Tax Information Reports by ETF

The following ETFs identify in their prospectus that they are grantor trusts for tax purposes. I have included a link to the fund trustee’s general “Tax Center” where the Tax Information Reports should be found (if available) and a direct link to the report (usually PDFs but exceptions are noted below).

Table last updated: February 6, 2025

ARK 21Shares Bitcoin ETF (ARKB) - 2024 Tax Information Report

21Shares Core Ethereum ETF (CETH) - 2024 Tax Information Report

CoinShares Valkyrie Bitcoin Fund (BRRR) - 2024 pending

Fidelity Wise Origin Bitcoin Fund (FBTC) - 2024 pending

Fidelity Ethereum Fund (FETH) - 2024 pending

Franklin Ethereum Trust (EZET) - 2024 Tax Information Report

Grayscale Bitcoin Trust ETF (GBTC) - 2024 Tax Information Report

Grayscale Ethereum Trust ETF (ETH) - 2024 Tax Information Report

Invesco Galaxy Bitcoin ETF (BTCO) - 2024 Tax Information Report

Invesco Galaxy Ethereum ETF (QETH) - 2024 Tax Information Report

iShares Bitcoin Trust ETF (IBIT) - 2024 Tax Information Report (Excel)

iShares Ethereum Trust (ETHA) - 2024 Tax Information Report (Excel)

VanEck Ethereum Trust (ETHV) - 2024 pending

WisdomTree Bitcoin Fund (BTCW) - 2024 Tax Information Report

Hashdex Bitcoin ETF (DEFI) is not in scope of this blog post discussion as its prospectus indicates that it is not a grantor trust but it is a publicly traded partnership which is a whole different complicated tax situation.

How can Dune Consultants help?

Contact us today to discuss at info@duneconsultants.com. Or you can jump in the calendar for an introduction call.